GET Fed’s Policy THAT Affects Mortgage-Treasury Spread NOW!

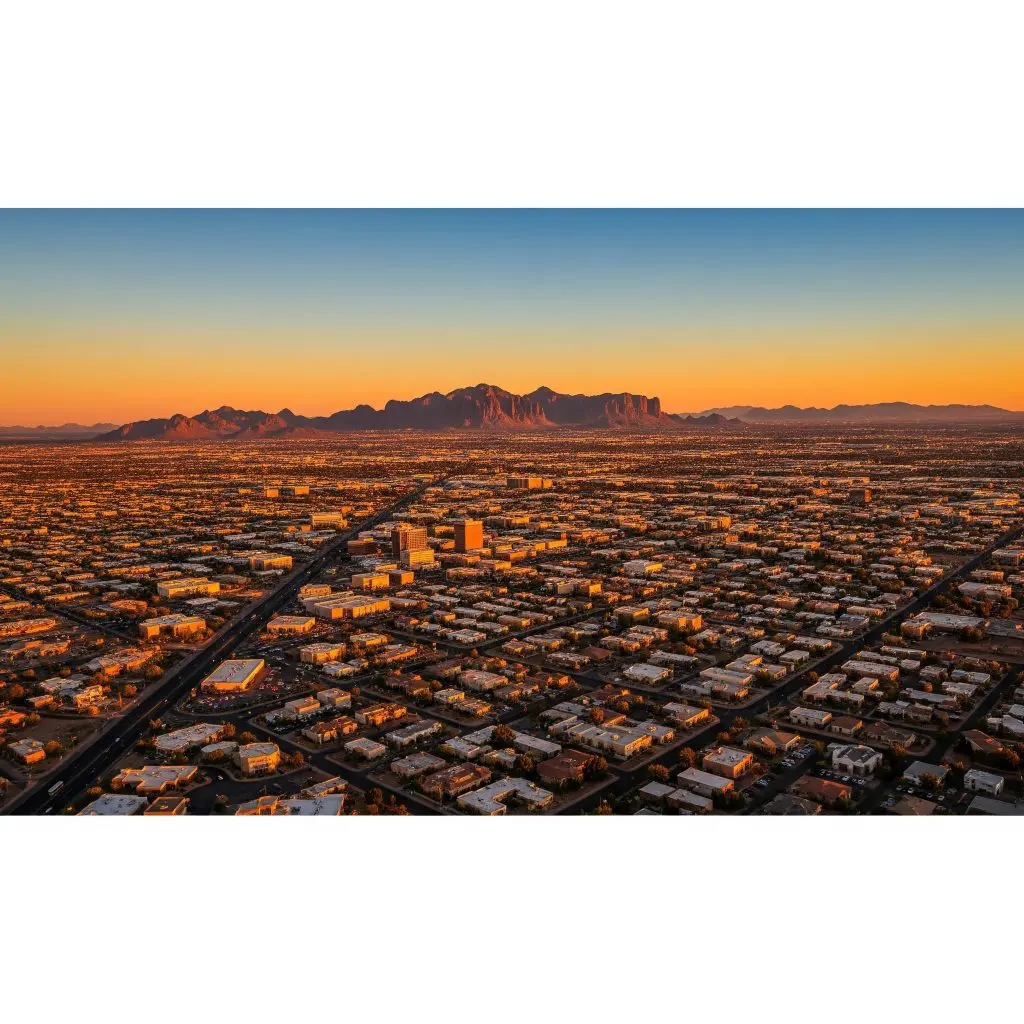

Navigating the Tides: How the Fed’s Policy Affects the Mortgage-Treasury Spread for Real Estate Investors in Arizona PHOENIX, AZ – JULY 13, 2025: For astute real estate investors, understanding the intricate dance between macroeconomic policy and local market dynamics is paramount to long-term success. One of the most crucial, yet often misunderstood, relationships is how […]

GET Fed’s Policy THAT Affects Mortgage-Treasury Spread NOW! Read More »