Streamline Your Success: The Essential Guide to an Online Rental Income and Expense Tracker with Cash Flow

Online Rental Income and Expense Tracker with Cash Flow NOW! The dream of a thriving rental property portfolio is often accompanied by the less glamorous reality of managing mountains of paperwork. From tracking rent payments and maintenance costs to categorizing every deductible expense, the administrative burden can quickly turn a passive income stream into an active headache. Manual spreadsheets, shoeboxes full of receipts, and fragmented data can lead to missed deductions, financial surprises, and a chaotic tax season.

But what if there was a better way? A way to consolidate all your financial data, automate tedious tasks, and gain real-time insights into your properties’ performance? Enter the online rental income and expense tracker with cash flow capabilities – a game-changer for landlords and real estate investors alike.

This comprehensive guide will show you why diligent financial tracking is non-negotiable for rental success, highlight the powerful features of online trackers, introduce you to popular options in the market, and demonstrate how leveraging this organized data can unlock new opportunities, including securing competitive financing from partners like GHC Funding. Say goodbye to guesswork and hello to informed, strategic property management.

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

In this article:

- Why Diligent Tracking Is Non-Negotiable for Rental Success

- The Power of an Online Rental Income and Expense Tracker

- Navigating the Market: Popular Online Trackers and What They Offer

- Beyond Tracking: Leveraging Your Data for Growth and Financing with GHC Funding

- Tips for Maximizing Your Online Tracker's Potential

- Your Path to Organized Rental Property Prosperity

Why Diligent Tracking Is Non-Negotiable for Rental Success

For any business, clarity on income and expenses is paramount. For rental properties, it’s not just about compliance; it’s about control, insight, and profitability. Many new landlords assume simply collecting rent is enough, but seasoned investors know the devil (and the profit) is in the details.

Here’s why diligent tracking is absolutely non-negotiable:

- Proactive Financial Management: Beyond just collecting rent, tracking helps you understand the true financial health of each property. You can identify which properties are cash flow positive, which are underperforming, and where your money is actually going. This knowledge is power.

- Informed Decision-Making: With clear data, you can make strategic decisions. Should you raise the rent? Are there expenses you can cut? Is it time to invest in an upgrade to justify higher rents, or perhaps even consider selling an underperforming asset? Data-driven decisions beat gut feelings every time.

- Simplified Tax Season: Tax time for landlords can be notoriously complex. Accurate, categorized income and expense records are essential for maximizing deductions and ensuring compliance with IRS Schedule E reporting. An organized system dramatically reduces stress and the risk of errors.

- Clear Data for Lenders: When you’re ready to expand your portfolio and apply for new loans, particularly specialized investment property loans like DSCR loans, lenders will want to see clear, verifiable financial statements for your existing properties. Robust income and expense tracking proves the viability of your investments and your financial management prowess.

- Prevent Financial Surprises: Unexpected maintenance, prolonged vacancies, or sudden increases in taxes can derail your budget. Consistent tracking helps you see trends, forecast potential issues, and build appropriate reserves, preventing costly surprises.

While manual spreadsheets or paper ledgers can offer some level of tracking, they often fall short in terms of efficiency, accuracy, and real-time insights. They are prone to errors, can be cumbersome to update, and don’t easily provide the comprehensive overviews needed for strategic decision-making. This is where the power of an online tracker comes in.

The Power of an Online Rental Income and Expense Tracker

An online rental income and expense tracker with cash flow reporting is a cloud-based software solution designed specifically for landlords and property managers. It centralizes all your rental property financial data, making it accessible from anywhere, at any time.

What should you look for in a powerful online tracker? Here are the key features that truly make a difference:

- Centralized Data Management: Say goodbye to scattered files. All your income, expenses, tenant information, and lease details are stored securely in one digital hub. This means you can access critical information instantly, whether you’re at home, at a property, or on the go.

- Automated Income Tracking: The best trackers allow you to easily log all forms of income. This includes monthly rent payments, but also late fees, pet fees, laundry income, parking fees, and more. Some even offer direct bank account synchronization or online rent collection features that automatically record payments as they arrive.

- Streamlined Expense Tracking & Categorization: This is where significant time and money can be saved.

- Categorization: Expenses are automatically or semi-automatically categorized (e.g., repairs, utilities, property taxes, insurance, management fees) often aligning with IRS Schedule E, simplifying tax preparation.

- Receipt Attachment: Many platforms allow you to upload or snap photos of receipts directly, linking them to specific transactions. This eliminates physical clutter and provides a crucial audit trail.

- Bank Account Sync: For even greater automation, some advanced trackers can securely sync with your bank accounts and credit cards, importing transactions directly. You then simply review and assign them to the correct property and category.

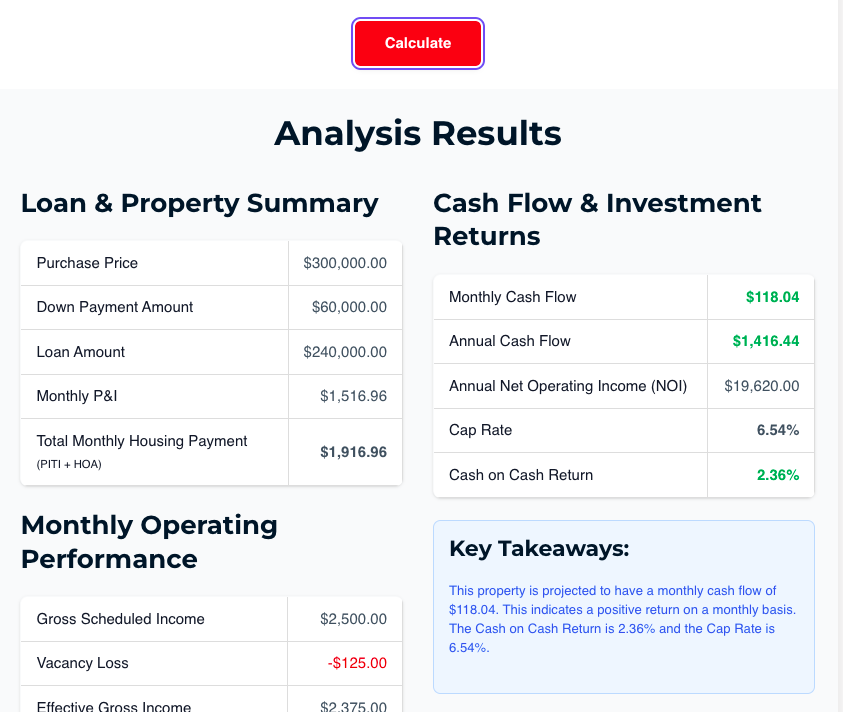

- Real-Time Cash Flow Reporting: This is the core advantage. The tracker automatically calculates your net cash flow for each property and your entire portfolio. You get instant insights into:

- Income vs. Expenses: A clear visual breakdown of money in versus money out.

- Profit & Loss (P&L) Statements: Essential for understanding profitability over specific periods.

- Cash Flow Statements: A detailed report showing the movement of cash, crucial for financial planning.

- Key Performance Indicators (KPIs): Many dashboards display metrics like cash-on-cash return, occupancy rates, and expense ratios, allowing you to quickly gauge performance.

- Tenant Management Integration (Often Included): While primarily financial tools, many trackers integrate basic tenant management features:

- Online rent collection and automatic reminders.

- Lease management and document storage.

- Maintenance request tracking.

- Tenant screening integrations.

- Tax Preparation Tools: Most trackers offer exportable reports (e.g., CSV, PDF) that summarize income and expenses by category, making it simple to hand over to your accountant or prepare your own Schedule E. Some even generate tax-ready reports directly.

- User-Friendly Interface: The best tools are intuitive and easy to navigate, ensuring that even landlords who aren’t tech-savvy can quickly get up and running and maintain accurate records without a steep learning curve.

The shift from manual tracking to an online system is transformative. It reduces errors, saves countless hours, and provides real-time financial insights that are simply impossible to achieve with paper or basic spreadsheets.

Navigating the Market: Popular Online Trackers and What They Offer

The market for online rental income and expense trackers with cash flow features has grown significantly, offering a range of options suitable for different portfolio sizes and needs. While pricing structures can vary (some offer a free basic tier, others operate on paid subscriptions with free trials), the core value lies in their ability to centralize and analyze your financial data.

Here are a few popular types of online trackers and what they typically offer:

- Dedicated Landlord Accounting Software (e.g., Stessa, Landlord Studio, Baselane, REI Hub):

- Focus: These platforms are purpose-built for rental property accounting. They excel at automated income and expense tracking, often integrating with bank accounts.

- Features: Strong emphasis on financial reporting (P&L, cash flow statements, Schedule E preparation), property-level tracking, and often a clean, easy-to-understand dashboard.

- Pricing: Some, like Stessa and Baselane, offer robust free plans for basic accounting and reporting, while others have affordable paid tiers. Baselane, for example, even offers integrated banking for landlords.

- Best for: Landlords primarily seeking robust financial tracking and reporting without needing full-blown property management features (though some offer basic versions).

- Full-Suite Property Management Software (e.g., Buildium, AppFolio, TenantCloud, RentRedi, Avail):

- Focus: These are comprehensive platforms that offer financial tracking as one component of a larger suite of tools, including tenant screening, online rent collection, lease management, maintenance tracking, and tenant communication portals.

- Features: Strong automation for rent collection and expense logging, detailed financial reporting for portfolio insights, and often integrations with other services. TenantCloud, for instance, offers various accounting reports and bank reconciliation.

- Pricing: Typically subscription-based, with pricing often scaling by the number of units. Some offer free trials or limited free plans for a very small number of units (e.g., TenantCloud has a free plan for up to 75 units, Avail has a free plan for up to 1 unit).

- Best for: Landlords who want an all-in-one solution to manage every aspect of their rental business, from tenant relations to financial reporting.

- General Small Business Accounting Software with Rental Features (e.g., QuickBooks Online, FreshBooks):

- Focus: While not exclusively for landlords, these platforms are widely used by small businesses and can be adapted for rental property accounting.

- Features: Strong general accounting capabilities, bank reconciliation, invoicing (for rent), and extensive reporting. Some offer industry-specific templates or integrations.

- Pricing: Generally paid subscriptions, but they are robust and versatile.

- Best for: Landlords who might also have other small businesses and prefer to consolidate their accounting in one familiar ecosystem.

When choosing an online rental income and expense tracker with cash flow features, consider your portfolio size, budget, comfort level with technology, and the specific features most important to you. Many offer free trials, so you can test them out before committing. Look for security features (data encryption, secure logins) to protect your sensitive financial information.

Beyond Tracking: Leveraging Your Data for Growth and Financing with GHC Funding

Once you’ve implemented an efficient online rental income and expense tracker with cash flow insights, you’re not just organized; you’re empowered. The clean, verifiable financial data generated by these tools becomes your most powerful asset for strategic decision-making and, crucially, for securing future investments.

When you’re ready to expand your rental property portfolio, access to capital is key. Lenders need to see a clear picture of your existing properties’ performance to assess risk and approve new loans. This is where the accurate reports from your online tracker truly shine.

GHC Funding is a specialized financial partner for real estate investors, providing expert guidance and tailored financing solutions, including commercial real estate (CRE) loans and business loans. They understand the unique financial dynamics of investment properties and how to effectively structure loans for growth.

How does your online tracker benefit your financing journey with GHC Funding?

- Demonstrate Property Viability: The detailed cash flow reports (P&L statements, income/expense summaries) generated by your tracker provide concrete evidence of your property’s profitability. This is invaluable, especially for loans like Debt Service Coverage Ratio (DSCR) loans, where the property’s income-generating ability is a primary qualifying factor. You can quickly show that the property generates enough income to cover its mortgage payments and operating expenses.

- Showcase Financial Sophistication: Presenting organized, professional financial reports from a dedicated online tracker demonstrates your competence as a landlord and investor. This inspires confidence in lenders and can lead to more favorable loan terms.

- Streamlined Application Process: Having all your financial data neatly categorized and accessible means you can quickly provide the necessary documentation for loan applications, significantly speeding up the approval process. No more scrambling for old receipts or trying to piece together a chaotic spreadsheet.

- Competitive Advantage: In a competitive lending landscape, clear, verifiable financial health gives you an edge. GHC Funding appreciates investors who have a firm grasp on their numbers, as it minimizes their risk and allows them to offer more compelling loan solutions.

Visit www.ghcfunding.com today to learn more about their investor-focused loan programs. With your online tracker providing the financial proof, GHC Funding can help you leverage your existing success into new acquisition opportunities, ensuring your real estate investment journey continues to grow seamlessly.

Tips for Maximizing Your Online Tracker’s Potential

Simply signing up for an online tracker isn’t enough; consistent effort will yield the best results.

- Consistent Data Entry: Make it a habit to log income and expenses as they occur. Don’t let tasks pile up, as this can lead to errors and overwhelm.

- Categorize Correctly: Take the time to understand and consistently apply expense categories. This is vital for accurate reporting and tax preparation.

- Regularly Review Reports: Don’t just input data; analyze it. Schedule monthly or quarterly reviews of your cash flow statements, P&L reports, and other dashboards. Look for trends, identify areas of overspending, and pinpoint opportunities to boost income.

- Utilize Automation Features: If your chosen tracker offers bank syncing, online rent collection, or recurring expense automation, set them up! These features significantly reduce manual work and improve accuracy.

- Attach Receipts Digitally: Always upload or link digital copies of receipts to their corresponding transactions. This creates a robust digital paper trail for tax purposes and potential audits.

- Leverage Alerts: Many platforms allow you to set up custom alerts, for instance, notifying you if a tenant payment is late or if a property’s cash flow dips below a certain threshold.

Your Path to Organized Rental Property Prosperity

The complexities of managing rental property finances no longer need to be a barrier to your investment goals. By embracing an online rental income and expense tracker with cash flow capabilities, you transform a potentially chaotic administrative burden into a streamlined, insightful, and strategic advantage.

This powerful tool doesn’t just simplify your bookkeeping; it provides the real-time financial clarity you need to make smarter investment decisions, identify growth opportunities, and, ultimately, maximize your returns. From easier tax preparation to stronger loan applications, an organized financial foundation is the cornerstone of long-term rental property success.

Choose a tracker that fits your needs, commit to consistent data entry, and use the invaluable insights it provides to guide your portfolio. And when you’re ready to turn those strong cash flow reports into your next acquisition, remember that GHC Funding is here to help you secure the financing to make it happen. Start your journey to organized, profitable rental property ownership today!

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources