Unlocking Growth: Your Comprehensive Guide to SBA Loan Terms and Rates for Small Businesses in 2025 🚀

Atlanta – October 30, 2025: For small business owners, accessing the right capital is the essential fuel for growth. In the dynamic economic landscape of 2025, the Small Business Administration (SBA) loan programs, particularly the flagship SBA 7(a) Loan, stand out as the gold standard for long-term, affordable financing. If you’re looking to overcome cash flow challenges, fund expansion, or finally purchase that vital piece of equipment, understanding the current SBA loan terms and rates for small businesses in 2025 is your first critical step.

- Unlocking Growth: Your Comprehensive Guide to SBA Loan Terms and Rates for Small Businesses in 2025 🚀

- Current Market Insights: SBA 7(a) Loan Rates in 2025

- The Unbeatable Benefits of SBA Loan Requirements

- Your Georgia Growth Partner: Why GHC Funding is the Go-To Lender 🌟

- Advanced Geo-Targeting: Funding Small Businesses Across Georgia 🍑

- Frequently Asked Questions (Q&A) about SBA Loans in 2025

- Beyond Funding: Essential Georgia Small Business Resources

- Your Next Step: Secure Your Capital and Fuel Your Ambition

This authoritative guide breaks down the essential information you need, with a special focus on securing your funding through an expert lender like GHC Funding.

SBA Loan Terms and Rates in Georgia

- Current Market Insights: SBA 7(a) Loan Rates in 2025

- The Unbeatable Benefits of SBA Loan Requirements

- Your Georgia Growth Partner: Why GHC Funding is the Go-To Lender 🌟

- Advanced Geo-Targeting: Funding Small Businesses Across Georgia 🍑

- Frequently Asked Questions (Q&A) about SBA Loans in 2025

- Q1: How long does the SBA loan process take in 2025?

- Q2: What can I use the SBA loan funds for?

- Q3: Do I need perfect credit to qualify for an SBA loan?

- Q4: Are SBA loans better than a traditional bank loan?

- Q5: Is collateral required for an SBA 7(a) loan?

- Q6: What is the maximum SBA loan amount in 2025?

- Q7: Are there any annual fees associated with an SBA loan?

- Beyond Funding: Essential Georgia Small Business Resources

- Your Next Step: Secure Your Capital and Fuel Your Ambition

Current Market Insights: SBA 7(a) Loan Rates in 2025

SBA 7(a) loans are government-guaranteed, but they are originated and serviced by partner lenders. This structure results in favorable terms and rates compared to many conventional bank loans.

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

What to Expect for Interest Rates (As of October 2025)

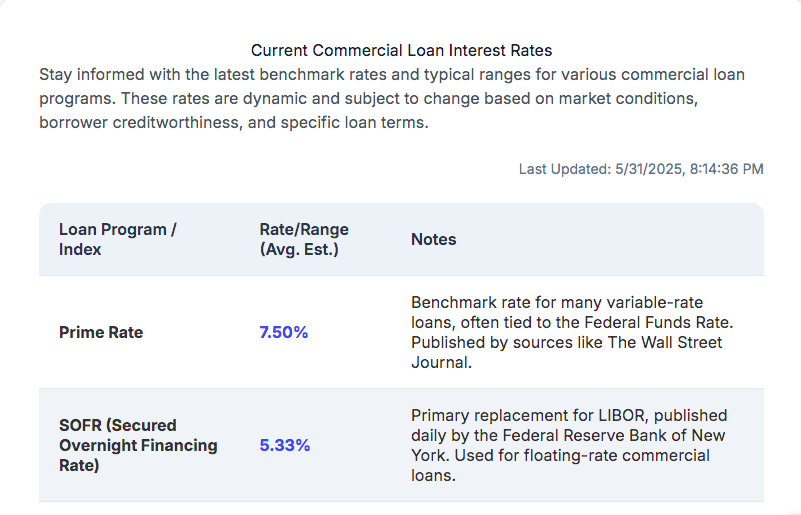

SBA loan interest rates are set by a maximum rate tied to the Prime Rate (a major interest rate used by banks), plus a fixed spread (or margin) that the lender is allowed to charge.

As of October 2025, with the Prime Rate at 7.25%, the maximum allowed rates for SBA 7(a) loans are:

| Loan Amount | Maximum Fixed Interest Rate | Maximum Variable Interest Rate |

| Up to $25,000 | Prime + 8.00% (15.25%) | Prime + 6.50% (13.75%) |

| $25,001 to $50,000 | Prime + 7.00% (14.25%) | Prime + 6.50% (13.75%) |

| $50,001 to $250,000 | Prime + 6.00% (13.25%) | Prime + 6.00% (13.25%) |

| Over $250,000 | Prime + 5.00% (12.25%) | Prime + 3.00% (10.25%) |

Key Takeaway on Rates: The rates listed above are the maximums. Your final, negotiated rate will typically fall within a lower range, sometimes significantly so, depending on several key factors.

Factors Influencing Your Final SBA Interest Rate

Your loan rate isn’t set in stone. Lenders like GHC Funding will assess your unique risk profile based on:

- Business Credit Score (SBSS): The SBA uses the FICO Small Business Scoring Service (SBSS) for prescreening, often requiring a minimum score. A higher score directly correlates to lower rates.

- Time in Business: Established businesses (typically 2+ years) with a proven track record of stable revenue and profitability are viewed as lower risk and qualify for better terms.

- Annual Revenue & Cash Flow: Your business’s ability to comfortably service the new debt, often measured by a Debt Service Coverage Ratio (DSCR), is paramount. Strong financials lead to lower rates.

- Personal Credit Score: For all owners with a 20% or more stake, a personal credit score, typically 680 or higher, is necessary to demonstrate repayment responsibility.

- Available Collateral: While the SBA offers collateral flexibility, having tangible assets (like commercial real estate or machinery) to secure the loan can help negotiate a more favorable rate.

The Unbeatable Benefits of SBA Loan Requirements

Forget the restrictive terms of short-term loans or the frustrating rejections from traditional large banks. The core value of the SBA 7(a) program lies in its friendly requirements and long repayment structures, specifically designed to help small businesses thrive.

Key Requirements and Unique Benefits:

- Flexible Use of Funds: Use the capital for nearly any legitimate business purpose. This can include:

- Working Capital for daily operations or inventory.

- Equipment Purchases (e.g., new manufacturing machinery or commercial kitchen upgrades).

- Business Acquisition funding.

- Refinancing high-interest business debt.

- Long Repayment Terms: This is the program’s unique selling proposition. Longer terms mean dramatically lower monthly payments, which is a lifesaver for business cash flow:

- Working Capital/Equipment: Up to 10 years.

- Real Estate: Up to 25 years.

- Lower Down Payment Requirements: Unlike conventional real estate loans that often demand 20-30%, the down payment for an SBA 7(a) is often as low as 10% for real estate projects.

- No Prepayment Penalties: For most SBA 7(a) loans with a term of 15 years or less, there are no prepayment penalties. This flexibility allows you to aggressively pay down the principal if cash flow improves, without penalty. For loans over $50,000 with terms over 15 years, there is a sliding-scale penalty for prepaying more than 25% of the outstanding balance in the first three years, but this still offers more flexibility than many alternative loans.

- Eligibility: Must be a for-profit business, operating legally in the U.S. (or its territories), and not be delinquent on any U.S. Government debt.

Your Georgia Growth Partner: Why GHC Funding is the Go-To Lender 🌟

The SBA process can be complex, and a generic loan officer at a huge national bank simply won’t have the time or specialized knowledge to advocate for your unique business. That’s why working with a dedicated expert like GHC Funding is a game-changer.

Expertise and Personalized Guidance

GHC Funding (www.ghcfunding.com) specializes in securing the right capital for your needs. They offer not just SBA 7(a) loans and SBA 504 Loans, but also Bridge Loans and Working Capital Solutions. Their deep expertise in navigating the stringent SBA approval process means:

- Streamlined Application Process: They know the paperwork inside and out, ensuring your application is complete, compelling, and submitted correctly the first time, drastically reducing delays.

- Personalized Guidance: You are not just a number. GHC Funding works one-on-one with you to structure the best deal, maximize your loan amount, and secure the most favorable terms for your specific project.

- Advocacy: When you partner with GHC Funding, you have a dedicated advocate fighting on your behalf to secure the best rates and terms the SBA allows, something large banks are often unwilling to do.

If you are frustrated with traditional bank rejections or restrictive lines of credit, explore the expert financial solutions offered by GHC Funding (www.ghcfunding.com).

Advanced Geo-Targeting: Funding Small Businesses Across Georgia 🍑

The economic engine of Georgia is fueled by thriving small businesses. Whether you’re in the bustling Metro Atlanta area or the state’s growing manufacturing hubs, SBA funding is the key to your next step.

Funding Across the Peach State

- Metro Atlanta (30303, 30339): Atlanta’s economy is dominated by finance, technology, logistics, and a vibrant film industry. A retail business in the popular Buckhead district (zip code 30303) might secure an SBA 7(a) loan to fully fund a complete store renovation and upgrade equipment, securing a 10-year term to keep monthly costs low. A service-based IT company near the Cumberland/Galleria Commercial District (zip code 30339) could use the funds for Working Capital to hire specialized developers and expand their team.

- Savannah: Home to one of the largest and fastest-growing ports in the U.S., the economy is driven by logistics and manufacturing. A small freight forwarding or logistics firm might use an SBA 504 Loan (which GHC Funding also specializes in) to purchase a commercial warehouse near the port, benefiting from the long-term, fixed-rate financing for major assets.

- Macon & Columbus: These cities have a strong base in aerospace, manufacturing, and healthcare. A light manufacturing business in Macon could leverage a 7(a) loan to upgrade aging, high-cost machinery, transitioning to more efficient equipment and freeing up cash flow.

Frequently Asked Questions (Q&A) about SBA Loans in 2025

This section addresses common queries small business owners have about the SBA loan process.

Q1: How long does the SBA loan process take in 2025?

The timeline can vary based on the loan size and lender. For the most streamlined loans (SBA Express up to $500,000), approval can take a few days, with funding in a few weeks. For a standard 7(a) or 504 loan, the process typically takes 60 to 90 days from application to closing. Working with an expert like GHC Funding (www.ghcfunding.com) can significantly expedite the process by ensuring all documents are prepared correctly from day one.

Q2: What can I use the SBA loan funds for?

SBA 7(a) funds are highly flexible. You can use them for almost any legitimate business purpose, including:

- Real estate purchase or renovation

- Equipment and machinery

- Working capital

- Inventory purchase

- Business acquisition or change of ownership

- Refinancing existing, high-cost business debt

Q3: Do I need perfect credit to qualify for an SBA loan?

No, you don’t need “perfect” credit, but you do need good credit. Most lenders look for a personal credit score of 680 or higher for all owners with a 20%+ stake. Your business financials and cash flow history, which demonstrate your ability to repay the loan, are often more important than a pristine credit score alone.

Q4: Are SBA loans better than a traditional bank loan?

Often, yes, especially for long-term needs. SBA loans offer distinct advantages: lower down payments, longer repayment terms (up to 25 years for real estate), and no balloon payments, leading to predictable, lower monthly payments that greatly benefit cash flow. They are specifically structured to reduce risk for the lender, which in turn allows them to offer more favorable terms to you.

Q5: Is collateral required for an SBA 7(a) loan?

The SBA requires that a lender not decline a loan solely because of a lack of collateral, but they must take collateral when available. For loans over ,000, lenders will secure the loan with all available business and personal assets (including real estate and equipment). The SBA’s guarantee makes them more flexible than conventional banks, who often require 100% of the loan amount to be secured by hard assets.

Q6: What is the maximum SBA loan amount in 2025?

The maximum loan amount for the standard SBA 7(a) program is million.

Q7: Are there any annual fees associated with an SBA loan?

Yes, the SBA charges an annual service fee on the outstanding guaranteed portion of the loan. This is separate from the interest rate. Additionally, there are upfront guarantee fees based on the loan amount and term length (though these fees are waived or reduced in some cases, such as for small manufacturers in Fiscal Year 2026). These fees are often incorporated into the loan’s cost.

Beyond Funding: Essential Georgia Small Business Resources

Securing capital is just one part of your growth plan. As a small business owner in Georgia, you should leverage these invaluable, high-quality, non-lender resources for mentorship, education, and support:

- SBA Georgia District Office: Your direct link to the U.S. Small Business Administration.

- Contact: 233 Peachtree St. NE, Suite 300, Atlanta, GA 30303. Phone: 404-331-0100. Visit the SBA Georgia District Office for local updates and resources.

- SCORE Georgia Chapter: Get free, expert mentorship from experienced entrepreneurs and executives.

- Resource: Find a SCORE Mentor in Atlanta, Northeast Georgia, or a surrounding chapter to help with business planning and strategy.

- University of Georgia Small Business Development Center (UGA SBDC): Access no-cost consulting services and low-cost educational programs across 18 locations in the state.

- Resource: Explore UGA SBDC services for financial analysis, loan proposal preparation, and market research.

- Georgia Chamber of Commerce: Connect with fellow business leaders and stay informed on state policy.

- Resource: Connect with the Georgia Chamber of Commerce for networking and advocacy.

Your Next Step: Secure Your Capital and Fuel Your Ambition

Don’t let the complexity of financing hold back your business dreams. The favorable SBA loan terms and rates for small businesses in 2025 are an incredible opportunity to stabilize and expand your operations. Whether you need to acquire a new facility in Savannah or inject working capital into your Atlanta tech startup, the path is clear.

Ready to simplify the SBA process and secure the capital you need?

📞 Call the experts at GHC Funding today for a no-obligation consultation: 833-572-4327

Or, visit their website to learn more about their specialized SBA 7a loans, SBA 504 Loans, Bridge Loans, and Working Capital Solutions: www.ghcfunding.com

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources