Contributing Author & Editorial Review

This article was crafted and reviewed by experienced professionals to ensure accuracy and practical insight.

DSCR Rental Loan Highlights

- Qualification based mainly on property cash flow (DSCR).

- No personal income docs required for many programs.

- Financing for 1–8 unit rentals, portfolios, and many STR/Airbnb deals.

- Up to 80% LTV on purchases and 75% LTV on cash-out (program-dependent).

- 30-year fixed and interest-only options available.

Best Real Estate Investment Strategies for Passive Income: A Tennessee Guide

Real estate investing is a proven path to building wealth, but for many, the idea of becoming a landlord seems like a full-time job in itself. The good news is that you don’t have to be a full-time manager to generate significant passive income. The key is to choose the right strategy and, most importantly, the right financing. This guide will walk you through the best real estate investment strategies for passive income, with a specific focus on the opportunities available in the thriving Tennessee market.

- Strategy 1: The Classic Buy-and-Hold for Long-Term Cash Flow

- Strategy 2: Short-Term Rentals for Higher Yields

- Why GHC Funding is Your Ideal Partner in Tennessee

- Volunteer State’s Best Markets

- Resources for Tennessee Real Estate Investors

- Common Questions from Passive Real Estate Investors (Q&A)

- Your Journey to Passive Income Begins Now

Strategy 1: The Classic Buy-and-Hold for Long-Term Cash Flow

The most straightforward and time-tested strategy for passive income is buying a rental property and holding it long-term. With this approach, your primary goal is to generate consistent monthly cash flow—the profit left over after all expenses are paid. This strategy is perfect for investors who want to build wealth slowly and steadily without the stress of flipping houses

The ideal financing for this strategy is a Debt Service Coverage Ratio (DSCR) loan. This loan product is a game-changer because it allows you to qualify for a mortgage based on the property’s ability to generate income, not your personal income. This is a crucial distinction that makes it a true passive investment strategy from the start.

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

DSCR Loan Rates and Requirements:

As of today, DSCR loan rates in Tennessee typically range from get rate quote. These rates are influenced by:

- Loan-to-Value (LTV): A lower LTV (higher down payment of 20-25%) will secure a better interest rate.

- Credit Score: While DSCR loans are more flexible, a higher credit score (680+) will lead to more favorable terms.

- DSCR: Lenders prefer a DSCR of at least 1.20x, meaning the property’s income is at least 20% more than its monthly mortgage payment.

The primary benefit for a passive investor is the no personal income verification policy. This means you don’t need to provide W-2s, tax returns, or proof of employment. The loan is typically held under a business entity, such as an LLC, which separates your personal finances from your investment.

Strategy 2: Short-Term Rentals for Higher Yields

In tourist hotspots and major cities, short-term rentals (like Airbnb or VRBO) can offer significantly higher cash flow than traditional long-term rentals. This strategy is less “passive” than a buy-and-hold, as it requires more management, but it can be made passive by hiring a professional property management company that specializes in short-term rentals. This is where a DSCR loan can again provide a huge advantage, as many conventional lenders are hesitant to finance properties used for short-term rentals.

Why GHC Funding is Your Ideal Partner in Tennessee

Navigating the world of investment property loans can be complex, but it doesn’t have to be. GHC Funding specializes in investor-centric products, including DSCR Loans, SBA 7a loans, SBA 504 Loans, Bridge Loans, and various Alternative Real Estate Financing solutions. They understand the nuances of passive real estate investing and provide the capital you need to make it happen.

GHC Funding’s unique advantages for Tennessee investors include:

- Flexible Underwriting: Their lending criteria are tailored to investors, focusing on the asset’s potential, not your personal financial statements.

- Market Expertise: The GHC Funding team has deep knowledge of the Tennessee market, from the booming urban cores to the growing suburban communities.

- Streamlined Process: They prioritize a fast and efficient closing process, helping you acquire properties quickly and with minimal hassle.

Volunteer State’s Best Markets

Tennessee’s economy is booming, attracting new residents and businesses, which creates a robust environment for real estate investment. Here are some of the most promising locations:

- Nashville: As the state capital and a national music and healthcare hub, Nashville offers a dynamic market. The median home price in Nashville’s Davidson County is around $433,000. Look for single-family rentals in popular areas like East Nashville (ZIP code 37206) or multi-family properties near the healthcare district in The Gulch for a steady stream of young professionals and medical staff.

- Memphis: Known for its affordability and strong rental yields, Memphis is a great market for passive investors. The median home price is approximately $250,000, with a steady rental demand. Focus on revitalizing neighborhoods like Midtown or suburbs like Germantown, where properties are still relatively affordable and offer solid cash flow.

- Knoxville: With a growing job market fueled by the University of Tennessee and a vibrant downtown, Knoxville is a strong choice. The median home price is about $350,000. Consider properties near the university campus (ZIP code 37916) for student housing or multi-family units in the downtown area for professionals.

- Chattanooga: Nicknamed the “Gig City” for its high-speed internet, Chattanooga is attracting tech companies and remote workers. The median home price is around $375,000. Focus on single-family homes in family-friendly suburbs or short-term rentals in the downtown area near attractions like the Tennessee Aquarium.

Resources for Tennessee Real Estate Investors

To succeed as a real estate investor, you need to stay informed. Here are some reputable, high-quality resources for the Tennessee market:

- Tennessee Real Estate Commission: The official state body for real estate laws, rules, and regulations. It’s a vital resource for staying compliant. https://www.tn.gov/commerce/regboards/trec.html

- Real Estate Investors of Nashville (REIN): A premier networking and educational organization for investors in the Nashville area. It provides valuable market insights and connections. https://www.reintn.org/

- Tennessee Real Estate Investors Association (TNREIA): A state-wide resource for real estate investors that offers educational events, networking, and support. https://tnreia.com/

- Tennessee Housing Development Agency: Provides data and resources related to housing, community development, and state demographics. https://thda.org/

- Memphis Investors Group: A well-established local group for investors in the Memphis market, offering educational events and resources. https://www.memphisinvestorsgroup.com/

Common Questions from Passive Real Estate Investors (Q&A)

Q1: How can I make real estate investing truly passive?

A1: The most effective way is to use a DSCR loan and hire a professional property management company. This combination allows you to delegate the time-consuming tasks of finding tenants, collecting rent, and handling maintenance, so your income truly becomes passive.

Q2: Is a DSCR loan a good option for a first-time investor?

A2: Yes, it is an excellent option. It removes the barrier of having to qualify with personal income, allowing you to focus on finding a strong, cash-flowing property. This simplifies the process and allows you to build your portfolio without impacting your personal debt-to-income ratio.

Q3: Can a DSCR loan be used for both long-term and short-term rentals?

A3: Yes, GHC Funding offers DSCR loan products for both long-term (traditional) and short-term rentals (like Airbnb or VRBO), giving you flexibility in your investment strategy.

Q4: Do I need a down payment for a DSCR loan?

A4: Yes, DSCR loans typically require a down payment of at least 20-25% of the purchase price. This is standard for most investment property loans and is a key factor in securing a favorable interest rate.

Q5: What’s the biggest difference between a traditional investment loan and a DSCR loan?

A5: The key difference is the underwriting. A traditional loan is a lengthy process focused on your personal finances. A DSCR loan is a streamlined, asset-based loan that looks at the property’s income potential, making it faster and more accessible for investors.

Q6: What if the rental income doesn’t cover the mortgage?

A6: This is where the DSCR comes in. Lenders won’t approve a DSCR loan unless the property’s income is at least 1.20x its expenses, providing a built-in safety net.

Q7: Can I use a DSCR loan to finance a fix-and-flip?

A7: DSCR loans are best for “buy and hold” properties that are already producing income. However, GHC Funding also offers Bridge Loans which are specifically designed for fix-and-flip projects, providing the short-term capital needed for renovations.

Get a Free Rate Today

Compare our top-rated commercial and investment property loan programs below.

- No income verification

- 30-year fixed | Interest-only available

- Great for rental properties + STR

- Fast approvals

- Working capital + business acquisition

- Up to $5M

- Low down payment

- Long-term financing

- Owner-occupied CRE

- Low fixed rates | 25-year terms

- Great for business expansion

- Refinance available

- Best for stabilized properties

- Competitive rates

- 12–25 year terms

- Lower fees than private lenders

Compare Loan Types

Find the Right Financing for Your Real Estate or Business Project

| Loan Type | Best For | Rates | Terms | Highlights | Apply |

|---|---|---|---|---|---|

| DSCR Loan | Rental properties (LTR & STR) | 5.99%+ | 30-year fixed, IO options | No income docs, fast approvals, great for investors | Check My Rate |

| Construction Loan | Ground-up, fix & build, major renovations | 8%–12% depending on scope | 12–24 months interest-only | Flexible draws, great for builders & developers | Get a Quote |

| SBA Loan | Business acquisition, working capital, CRE | Prime + spread | 10–25 years | Lowest down payments, long terms, best for business growth | See My Options |

Get The SBA Express Loan Application in Florida Now

GHC Funding Website Published: March 5, 2026 Categories: blog Reading Time: 3 minutes read Simplifying the SBA Express Loan Application Process in…

Read more →

Get SBA 7(a) or 504 loan in New York Now

GHC Funding Website Published: March 5, 2026 Categories: blog Reading Time: 3 minutes read SBA 7(a) vs 504 Loans: Navigating Business Financing…

Read more →

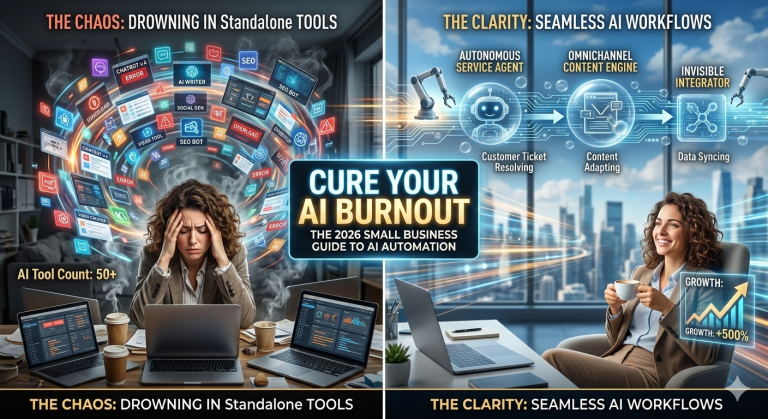

2026 Guide to AI for Small Business: Tools & Scaling Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 6 minutes read The 2026 Guide to…

Read more →

DSCR Loan Calculator with Taxes in New York Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 3 minutes read Unlocking Business Potential: Understanding…

Read more →

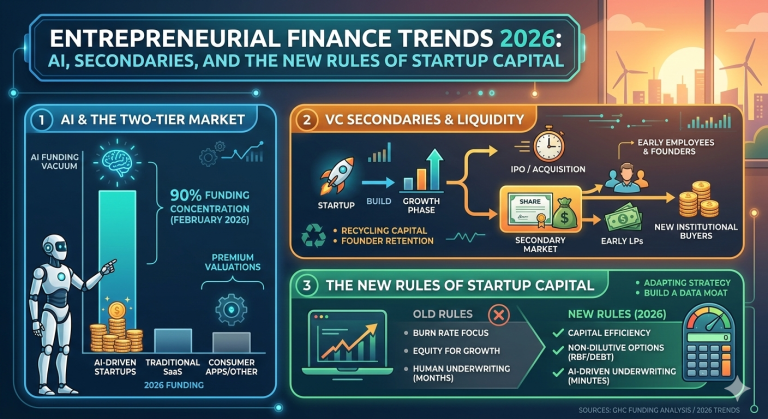

The Entrepreneurial Finance in 2026: Liquidity & AI Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 4 minutes read The New Rules of…

Read more →

Get The Entrepreneurial Finance Trends 2026 Now

GHC Funding Website Published: March 4, 2026 Updated: March 5, 2026 Categories: blog Reading Time: 8 minutes read Entrepreneurial Finance Trends 2026:…

Read more →Your Journey to Passive Income Begins Now

Building a real estate portfolio is a powerful path to financial freedom. By choosing the right financing, like a DSCR loan, and partnering with an expert lender, you can confidently navigate the Tennessee market and build a tangible source of passive income.

Don’t let the complexities of traditional financing hold you back. Let GHC Funding be your guide.

Visit GHC Funding at www.ghcfunding.com to explore your financing options, or call us directly at 833-572-4327 to speak with an expert about your first investment property.

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources