Unlock Hidden Profits: How to Calculate Depreciation on a Rental Property with the New Tax Laws (A Florida Investor’s Blueprint for 2025)

MIAMI, FL – JULY 12, 2025: For real estate investors across Florida – from the sun-drenched shores of Miami and the family-friendly communities of Orlando to the vibrant Gulf Coast cities like Tampa and Sarasota – understanding every nuance of your investment’s financial performance is key to long-term success. Beyond rental income and property appreciation, one of the most powerful yet often misunderstood tools in your financial arsenal is depreciation. With the enduring effects of President Trump’s “Big Beautiful Bill” – more formally known as the Tax Cuts and Jobs Act (TCJA) of 2017 – the landscape for calculating depreciation on rental properties has continued to evolve. This comprehensive guide will equip you with the knowledge to maximize your tax benefits and accelerate your portfolio growth right here in the Sunshine State.

Calculate Depreciation on Rental New Tax Laws in Florida:

- The Power of Depreciation: Your Non-Cash Deduction Advantage

- Understanding the Basics of Rental Property Depreciation in 2025

- The TCJA's Impact: Bonus Depreciation and Section 179

- Cost Segregation Studies: Unlocking Accelerated Depreciation

- Financing Your Next Smart Move: GHC Funding – Your Florida Advantage

- Current Florida Real Estate Market Insights (July 2025)

- Q&A Section: Calculate Depreciation on Rental in Florida

- Q1: What exactly changed about depreciation for rental properties with President Trump's "Big Beautiful Bill"?

- Q2: Can I depreciate land?

- Q3: What's the difference between a repair and a capital improvement for depreciation purposes?

- Q4: How does a DSCR loan from GHC Funding help me with depreciation strategies?

- Q5: What is a cost segregation study, and is it worth it for my Florida rental property?

- Q6: Are there specific property types in Florida that are better for maximizing depreciation?

- Q7: Can I take depreciation even if my property has a negative cash flow?

- External Resources for Florida Real Estate Investors

- Conclusion: Empower Your Florida Real Estate Journey

- How to calculate depreciation on a rental property with the new tax laws – GET A DSCR LOAN QUOTE NOW!

The Power of Depreciation: Your Non-Cash Deduction Advantage

Depreciation, in the world of real estate, isn’t about your property physically decaying. Instead, it’s an accounting method sanctioned by the IRS that allows you to deduct a portion of the cost of your rental property each year, reflecting its “wear and tear” and obsolescence over time. This non-cash deduction can significantly reduce your taxable income, effectively putting more money back into your pocket to reinvest, improve properties, or build your reserves.

Before the TCJA, depreciation was already a cornerstone of real estate investment. However, the “Big Beautiful Bill” brought about key changes that impact how much and how quickly you can depreciate certain assets, particularly regarding qualified improvement property and bonus depreciation.

Need capital? GHC Funding offers flexible funding solutions to support your business growth or real estate projects. Discover fast, reliable financing options today!

⚡ Key Flexible Funding Options:

GHC Funding everages financing types that prioritize asset value and cash flow over lengthy financial history checks:

DSCR Rental Loan

- No tax returns required

- Qualify using rental income (DSCR-based)

- Fast closings ~3–4 weeks

SBA 7(a) Loan

- Lower down payments vs banks

- Long amortization improves cash flow

- Good if your business occupies 51%+

Bridge Loan

- Close quickly — move on opportunities

- Flexible underwriting

- Great for value-add or transitional assets

SBA 504 Loan

- Low fixed rates through CDC portion

- Great for construction, expansion, fixed assets

- Often lower down payment than bank loans

🌐 Learn More

For details on GHC Funding's specific products and to start an application, please visit our homepage:

Understanding the Basics of Rental Property Depreciation in 2025

For residential rental properties, the IRS generally requires you to depreciate the cost of the building (not the land, as land does not “wear out”) over 27.5 years using the Straight-Line Depreciation method under the General Depreciation System (GDS). This means you can deduct 3.636% of the building’s depreciable basis each year.

Here’s a step-by-step guide to calculating depreciation on your Florida rental property:

- Determine Your Property’s Basis:This is your starting point. Your basis is generally the cost you paid for the property, plus any closing costs that aren’t deductible (like legal fees, title insurance, and recording fees) and the cost of any capital improvements you’ve made. It’s crucial to distinguish between capital improvements (which add value, extend the life, or adapt the property for new uses) and repairs (which maintain the property and are immediately deductible).Example: You purchase a rental duplex in Orlando (zip code 32801, near downtown’s growing urban core) for 0,000. Closing costs that add to your basis are $10,000. Your total initial basis is $410,000.

- Allocate Value Between Land and Building:As mentioned, you can only depreciate the building, not the land. You’ll need to allocate your total property basis between the land and the building. This can be done using the property tax assessment values (which typically provide separate land and building valuations) or through a professional appraisal. The IRS doesn’t specify a single method, but it must be reasonable.Example continued: The county tax assessor for your Orlando duplex values the land at $70,000 and the building at $330,000. Your building’s depreciable basis is $330,000.

- Determine the Placed-in-Service Date:Depreciation begins when the property is “placed in service” – meaning it’s ready and available for use as a rental, even if you haven’t secured a tenant yet.

- Calculate Annual Depreciation:Divide the depreciable basis of the building by 27.5 years (for residential rental property).Example continued: $330,000 (depreciable building basis) / 27.5 years = $12,000 annual depreciation.This means you can deduct $12,000 from your taxable income each year for 27.5 years. Imagine the tax savings over nearly three decades!

DSCR Loan IQ Quiz!

Test your knowledge of Debt Service Coverage Ratio (DSCR) loans!

The TCJA’s Impact: Bonus Depreciation and Section 179

President Trump’s “Big Beautiful Bill” aimed to stimulate business investment, and while its primary focus wasn’t directly on residential rental property structures, it significantly impacted other aspects of depreciation for real estate investors:

- Bonus Depreciation: The TCJA dramatically expanded bonus depreciation, allowing businesses to immediately deduct a larger percentage of the cost of qualifying new and used property. For property placed in service after September 27, 2017, and before January 1, 2023, 100% bonus depreciation was allowed. However, it began to phase down in 2023 (80%), then 2024 (60%), and for 2025, it is 40%. For 2026, it will be 20%, and then zero for 2027 and beyond.Crucially, this bonus depreciation primarily applies to personal property within your rental (e.g., appliances, furniture in a furnished short-term rental) and qualified improvement property (QIP).

- Qualified Improvement Property (QIP): This refers to improvements made to the interior of nonresidential real property after it was first placed in service. Due to a legislative oversight (the “retail glitch”), QIP was initially excluded from 15-year recovery periods and thus bonus depreciation. A subsequent fix, the CARES Act, retroactively corrected this oversight. This means that some improvements to existing rental properties might now qualify for accelerated depreciation, depending on the specific nature of the improvement and its classification. Always consult with a tax professional.

- Section 179 Deduction: The TCJA significantly increased the maximum Section 179 deduction and the phase-out threshold. For 2025, the maximum Section 179 deduction is projected to be around $1,220,000, with a phase-out threshold of approximately $3,050,000. This deduction allows you to expense the full cost of certain depreciable property in the year it’s placed in service, rather than depreciating it over time.

- Expanded Definition: The TCJA also expanded the definition of Section 179 property to include certain improvements to nonresidential real property, such as roofs, HVAC, fire protection, alarm systems, and security systems. This is a huge benefit for investors upgrading existing Florida properties, from historic homes in St. Petersburg (zip code 33701, for single-family rentals) to commercial spaces in Jacksonville (zip code 32202, for downtown revitalization projects), as these specific improvements might be fully deductible in the year they’re incurred, provided you meet the limits and actively participate in the rental activity.

Cost Segregation Studies: Unlocking Accelerated Depreciation

For Florida investors looking to maximize their depreciation deductions, especially on newer acquisitions or recently renovated properties, a cost segregation study is a highly valuable tool. This specialized tax strategy involves a detailed analysis of your property’s components, reclassifying certain elements that would typically be depreciated over 27.5 years (or 39 years for commercial) into shorter depreciation periods (5, 7, or 15 years).

For instance, items like landscaping, parking lots, certain electrical systems, specialized plumbing, and even specific types of cabinetry or flooring might be reclassified as personal property or land improvements, allowing for significantly faster depreciation write-offs. This can generate substantial tax savings in the early years of ownership, boosting your cash flow. Imagine accelerating deductions on a brand-new short-term rental in Kissimmee (zip code 34747, near theme parks), where fixtures and furnishings are a major component.

The Ultimate Quiz on Going Passive in Real Estate

Are you ready to transition from an active landlord to a savvy, passive real estate investor? True success in "Going Passive in Real Estate" isn't just about buying property; it's about smart strategies and leveraging the right tools to build wealth without the daily grind. This quiz is designed to test your knowledge on the key concepts that separate the hands-on hustlers from the hands-off investors. See how well you understand the fundamentals of building a truly passive income stream through real estate

Financing Your Next Smart Move: GHC Funding – Your Florida Advantage

Understanding depreciation is powerful, but transforming those insights into tangible wealth requires the right financial partners. Whether you’re looking to acquire new properties to capitalize on these tax benefits, refinance existing assets, or simply need flexible capital, GHC Funding is uniquely positioned to serve Florida real estate investors. We understand the nuanced market dynamics from the Gold Coast to the Panhandle and offer specialized loan products designed for today’s savvy investor, often sidestepping the traditional lender hurdles.

Why GHC Funding is the Preferred Lender for Florida Investors in 2025:

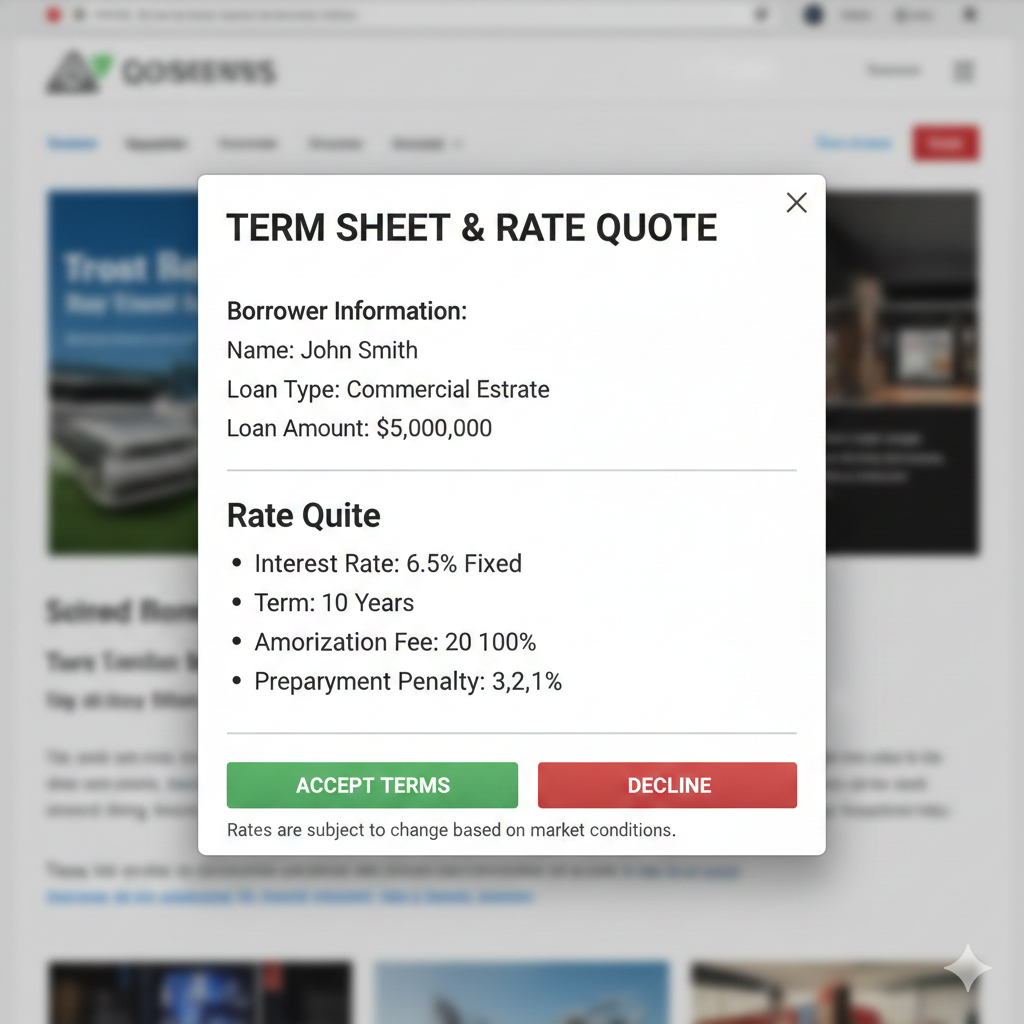

- DSCR Loans (Debt Service Coverage Ratio): Ideal for investors focused on cash-flowing rental properties in high-demand Florida markets like Fort Lauderdale (zip code 33301, for multi-family units) or Naples (zip code 34102, for luxury vacation rentals). DSCR loans qualify based on the property’s income-generating potential, not your personal income, making them perfect for scaling your portfolio without traditional W-2 or tax return verification.

- Current Rates (as of July 12, 2025): DSCR loan rates in Florida typically range from 6.75% to 8.50%. Factors influencing your specific rate include the property’s DSCR (a higher ratio, often 1.25x or greater, typically leads to better rates), Loan-to-Value (LTV), your credit score (generally 660+ preferred), and the property type (SFR, multi-family, short-term rental, mixed-use).

- Requirements: Minimum DSCR generally 0.75x-1.25x+. LTVs typically up to 75-80% for purchases (refinances may vary). No personal income verification (no W-2s, pay stubs, or tax returns required). Borrower entities (LLCs, corporations) are preferred. Most residential investment property types are accepted, including 1-4 unit properties, condos, and even some short-term rentals.

- SBA 7a Loans & SBA 504 Loans: If you’re acquiring real estate for your operating business in Florida – perhaps a warehouse in Lakeland (zip code 33801, a growing logistics hub) or an office building in Boca Raton (zip code 33431, for professional services) – SBA loans offer competitive terms with lower down payments and longer repayment schedules, ideal for owner-occupied commercial real estate.

- Bridge Loans: Need to close quickly on a hot deal in Sarasota (zip code 34236, for waterfront properties) before your existing property sells? Our Bridge Loans provide rapid, short-term capital, allowing you to make competitive, non-contingent offers and secure lucrative opportunities.

- Alternative Real Estate Financing: We specialize in flexible solutions for unique investor profiles, including those with substantial assets but non-traditional income streams. Our underwriting is adaptive to the modern investor.

At GHC Funding, our flexible underwriting, in-depth understanding of the Florida market, and commitment to a streamlined, efficient process empower investors to make smart, swift decisions.

Visit GHC Funding at www.ghcfunding.com to discover how we can fuel your investment success!

Test Your Expertise: The Complexities of the 1031 Exchange

As a sophisticated real estate investor, you understand that the 1031 Exchange is a cornerstone strategy for tax deferral and wealth accumulation. But beyond the basics, the intricacies of the 1031 Exchange rules can pose significant challenges. This quiz is designed to test your in-depth knowledge and highlight critical nuances that separate casual investors from true experts in 1031 Exchange transactions.

Instructions: Choose the best answer for each question.

Current Florida Real Estate Market Insights (July 2025)

The Florida real estate market remains a dynamic landscape for investors. As of July 2025, median home prices across Florida are showing some stabilization after rapid appreciation, with some areas experiencing slight corrections while others continue to see strong demand.

- Median Sale Price (Florida, May 2025): Approximately $412,400 (Source: Redfin).

- Average Rental Rates (Florida, June 2025): Approximately $2,069 (Source: Zillow).

Key trends for Florida investors to note:

- Population Growth: Florida continues to experience significant inbound migration, driving sustained demand for both rental housing and property purchases, particularly in metropolitan areas like Tampa (zip code 33602, for urban core apartments) and Cape Coral (zip code 33904, for single-family and vacation homes).

- Interest Rate Environment: While the Federal Reserve’s actions continue to influence the broader rate environment, commercial and investment property loan rates for DSCR products are reflecting current market conditions. Investors should be prepared for rates that are higher than historical lows but still competitive given the non-QM nature of these loans.

- Insurance Costs: Florida investors must factor in increasing property insurance costs, particularly for properties in coastal areas or those susceptible to severe weather events. This can impact your property’s overall cash flow and DSCR calculation.

- Investment Niches: Opportunities abound in specific niches, from short-term rentals (Airbnbs) in tourist hotspots like Orlando (zip code 32819, near Disney) and Panama City Beach (zip code 32413, for beach rentals) to workforce housing in rapidly expanding industrial zones.

Q&A Section: Calculate Depreciation on Rental in Florida

Q1: What exactly changed about depreciation for rental properties with President Trump’s “Big Beautiful Bill”?

A1: The Tax Cuts and Jobs Act (TCJA) of 2017 primarily impacted depreciation by expanding bonus depreciation to include certain “qualified improvement property” (QIP) and used property, and significantly increasing Section 179 deduction limits. While the 27.5-year depreciation period for residential structures remained, these changes allow investors to accelerate deductions on components and improvements within their rental properties, especially in 2025 with 40% bonus depreciation.

Q2: Can I depreciate land?

A2: No, you cannot depreciate land. Land is considered to have an indefinite useful life and is not subject to wear and tear or obsolescence. When calculating depreciation, you must allocate your property’s basis between the land and the building.

Q3: What’s the difference between a repair and a capital improvement for depreciation purposes?

A3: A repair maintains the property in its ordinary operating condition (e.g., fixing a leaky faucet, painting a room) and is generally deductible in the year incurred. A capital improvement adds value, prolongs the property’s useful life, or adapts it to new uses (e.g., adding a new roof, replacing an entire HVAC system, a major renovation). Capital improvements are added to your property’s basis and depreciated over time.

Q4: How does a DSCR loan from GHC Funding help me with depreciation strategies?

A4: DSCR loans from GHC Funding are ideal because they don’t require personal income verification, allowing investors to quickly acquire properties without lengthy paperwork. This speed is crucial when timing property acquisitions to maximize depreciation benefits, especially with the expiring bonus depreciation percentages. By simplifying the financing, you can focus on optimizing your tax strategy and portfolio growth.

Q5: What is a cost segregation study, and is it worth it for my Florida rental property?

A5: A cost segregation study is an engineering-based analysis that identifies components of your property that can be reclassified from 27.5-year real property to shorter depreciation periods (5, 7, or 15 years). For many Florida rental properties, especially those that are newer, were recently renovated, or have significant landscaping/site improvements (like multi-family complexes in Fort Myers, zip code 33908), a cost segregation study can significantly accelerate depreciation deductions and boost your early-year cash flow. It’s often highly recommended for properties valued over $500,000.

Q6: Are there specific property types in Florida that are better for maximizing depreciation?

A6: Properties with a higher percentage of their value attributed to the building structure and components (rather than land) generally offer more depreciation potential. Multi-family properties, short-term rentals (due to significant personal property within them), and properties with recent capital improvements eligible for Section 179 or bonus depreciation often provide excellent opportunities for maximizing depreciation write-offs in Florida’s diverse markets, such as high-density apartments in Downtown Tampa (zip code 33602) or luxury vacation homes in Naples (zip code 34108).

Q7: Can I take depreciation even if my property has a negative cash flow?

A7: Yes, depreciation is a non-cash expense and can create a “paper loss” on your rental property even if it’s cash-flow positive or breaking even. However, passive activity loss (PAL) rules may limit your ability to deduct these losses against other income. These rules are complex, so consulting a tax professional is always advisable.

External Resources for Florida Real Estate Investors

- Florida Department of Business and Professional Regulation (DBPR) – Real Estate: https://www.myfloridalicense.com/real-estate-commission/ – The official state resource for real estate licensing, regulations, and consumer information in Florida.

- Florida Realtors: https://www.floridarealtors.org/ – Provides market data, legal resources, and industry insights for real estate professionals and investors across Florida.

- REIClub – Florida Real Estate Clubs: https://reiclub.com/real-estate-clubs/florida/ – A comprehensive directory of local real estate investor associations (REIAs) throughout Florida, ideal for networking and localized market intelligence (e.g., Central Florida Realty Investors Association, Tampa Bay Real Estate Investors Association).

- Zillow Florida Housing Market: https://www.zillow.com/home-values/14/fl/ – Offers up-to-date market data, home values, and rental trends across various Florida cities and zip codes.

- IRS Publication 527 (Residential Rental Property): https://www.irs.gov/forms-pubs/about-publication-527 – The official IRS guide providing detailed instructions on reporting rental income, deductions, and depreciation.

Conclusion: Empower Your Florida Real Estate Journey

Depreciation is a powerful, yet often underutilized, tool for real estate investors in Florida. By understanding the core calculations and leveraging the opportunities presented by the TCJA – especially regarding bonus depreciation and Section 179 deductions for qualified improvements – you can significantly reduce your taxable income, enhance your cash flow, and accelerate your wealth creation.

Don’t leave money on the table. Empower yourself with knowledge and partner with a lender that understands your unique needs.

How to calculate depreciation on a rental property with the new tax laws – GET A DSCR LOAN QUOTE NOW!

Get a No Obligation Quote Today.

Use these trusted resources to grow and manage your small business—then connect with GHC Funding

to explore financing options tailored to your needs.

GHC Funding helps entrepreneurs secure working capital, equipment financing, real estate loans,

and more—start your funding conversation today.

Helpful Small Business Resources