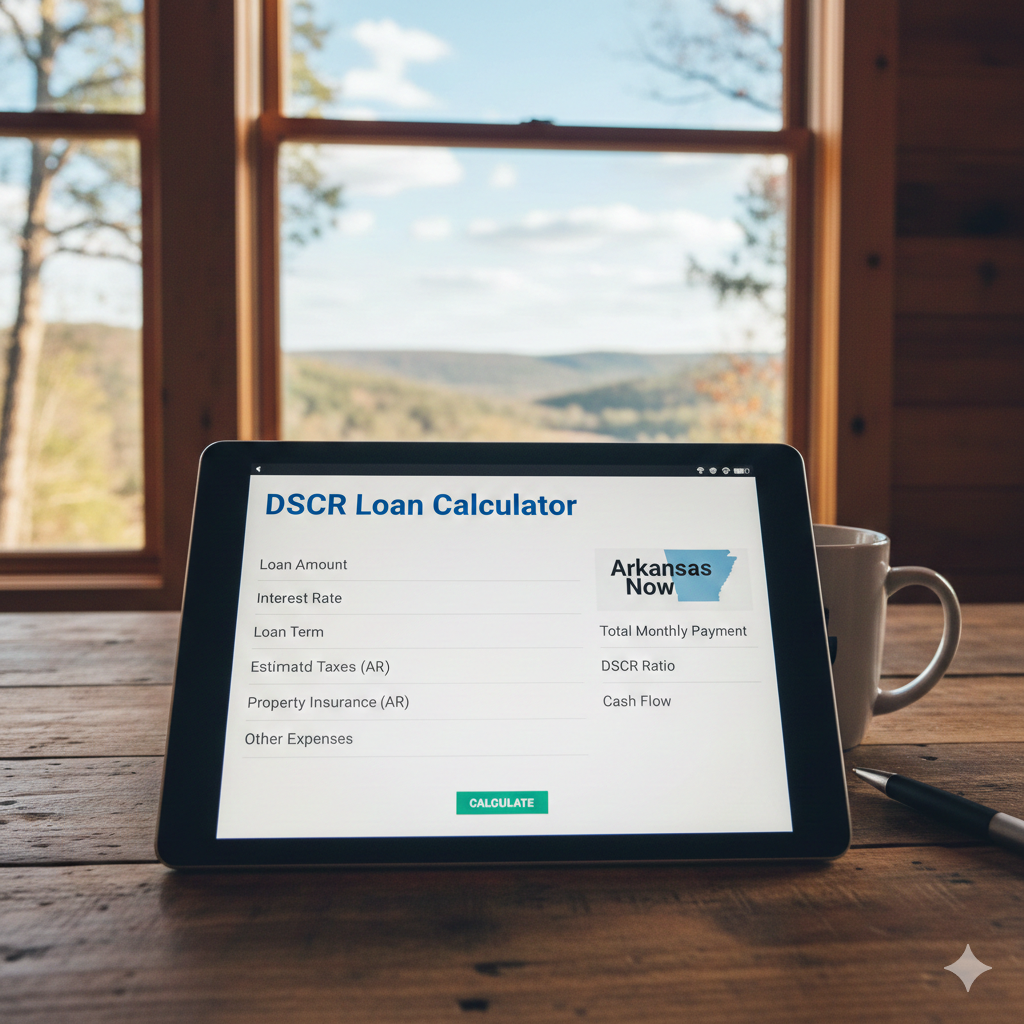

SBA loan rates 2026 in Arkansas Now

Understanding SBA Loan Rates in 2026: A Guide for Arkansas Business Owners In the heart of Little Rock, Sarah, a passionate entrepreneur, found herself at a crossroads. Her bakery, known for its delicious pastries and warm atmosphere, was flourishing. However, Sarah needed to expand to meet the growing demand. She realized that securing an SBA […]

SBA loan rates 2026 in Arkansas Now Read More »